Money has been cited as the determining factor of 21% of divorces in 2017 according to Magnify Money. The same survey noted the more money people made, the more money was a problem in their marriage. I grew up in a home, and now live in a house, where money isn’t fought over, so this alarmed me. I’m glad my eyes are open to this. I’m hoping to instill healthy views on money management to my children, so if and when they have a spouse and family someday, they will have healthy approaches to it, able to work through its inevitable conflictive nature.

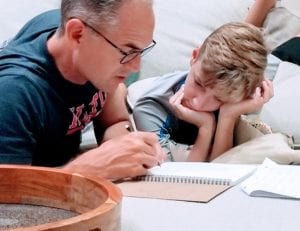

My husband and I were recently asked by some parents of younger kids if we paid for chores, or basically what we thought of allowances. At the table, there were different responses and reasons for each couples’ yeses or nos. Yes, in our house we do pay for some chores, not because the work deserves payment, but mostly to create a way to teach money management. Our system has evolved through the years as our kids grew older and more efficient management opportunities became available. Below are the things we have used over the years and our best attempts to teach them money management:

Ages 2-5: The Chorganizer & Daddy Dollars

We purchased this pre-made kit that hung on our fridge where the kids could choose 5 chores for the week. Each time a task was completed it was de-velcroed and placed in the pouch at the bottom. At the end of the week, they would receive a daddy dollar for each completed chore. They could then exchange daddy dollars for a prize depending on how much they earned. Most of the prizes we created were about spending time together.  They could also save up the daddy dollars from week to week to buy something more expensive, larger, like a sleepover in our room. We did this because we wanted to establish delayed gratification from the beginning. Each of our kids handled money differently, some spending right away on trips with us to the dollar store, while others held onto the daddy dollars for a bigger prize. I see now that hasn’t really changed much. The spender is still the spender as the saver is still the saver.

They could also save up the daddy dollars from week to week to buy something more expensive, larger, like a sleepover in our room. We did this because we wanted to establish delayed gratification from the beginning. Each of our kids handled money differently, some spending right away on trips with us to the dollar store, while others held onto the daddy dollars for a bigger prize. I see now that hasn’t really changed much. The spender is still the spender as the saver is still the saver.

https://www.amazon.com/Choreganizers-Visual-Organize-Household-Chores/dp/1568570023

Ages 6-13: Personal Responsibility Chart

As the kids got older, we made a chart of all the responsibilities each child needed to complete in a week, printed it off and placed it on the fridge. The kids were rewarded money at this age for the amount they completed and their attitude with which they completed it. We had categories like academics, chores, family and personal development categories. Items ranged from reading, going outside and practicing their sport to taking out the trash, etc. They could earn anywhere from $4-10/week. Our focus here was on their attitude while doing the things that were on their own personal responsibility chart. It wasn’t enough to just take out the trash, their attitude had to be healthy about it, and they were supposed to take initiative with those responsibilities. We stopped around 13 because they naturally began to take ownership of their lives and their decisions and went to a straight monthly budget they got to manage.

Ages 13-18: Monthly & Seasonal Budgets

We give our teenagers a seasonal clothing budget 3x a year (not a winter one because clothes come in wrapped packages under the tree in that season). The money is enough to buy some new things, but also just below the mark where they may need to add some of their own money. It teaches them to manage money on clothing and decide if quantity is their thing (off-brand), quality (adding a few name brand names) or if thrifting is the way for them to go. One of my daughters was voted most fashionable in her large, affluent high school. She did that on a shoestring budget, and I’m so proud of her for that. We also give them a monthly allowance for activities. Again, the amount is just enough for them to go to a weekly football game and get food afterward. The point here was to allow them autonomy on how they spend their money and for them to learn to budget out what they need to save or work towards for upcoming events. We opened up checking accounts and transfer money into their accounts each month or season.

Ages 6-18: Bank of Dad

My husband wanted to incent them to learn the value of saving early on, so he started an account called the Bank of Dad. When they gave him money for savings, he would match it 50%. Some of our kids have really done well with this, while others feel its a waste to save that money because they believe they won’t ever be able to spend it. We are still working on this. We put the Bank of Dad money into a savings account of their own once they turn 13.

Ages 6-18: Stockpile

We recently added this after a family member introduced it to us. This came from a desire to teach them the difference between short term saving and long term saving. Here they can invest in stock by buying fractions of shares. Our kids are able to learn how to pick a company they know and value and then invest in their future. They can put money in savings for the short term and then Stockpile for the long term. Our children have invested in companies like Tesla, Nike, Hershey. https://www.stockpile.com/

Ages 2-forever: Giving

It’s so important to us to model for them and teach them about giving a portion of their money away. We never told them how much, but let them decide that on their own. One supported a child in Kenya every month, another gives it to our local church. They are always generous, and it’s fun to see them be generous each week from their chore money or real-world job. It has become natural, a part of how they view money. I sure hope this continues. We have so much; they have so much. I hope their hearts are always generous and faithful to give.

Money is supposed to be a tool to be used to help you accomplish your vision and goals for your time on earth. I hope with the feeble and ever-changing attempts we have made that our children will have provided them some tools in their toolbox for money management as an adult, spouse, and parent. There are lots of things relationally to fight over, I hope their money management won’t be one of them.